HOME | PROJECTS | VOTER INFO | FAQS

$44 MILLION IN IMPROVEMENTS – OF WHICH THE STATE PAYS $7.3 MILLION

Branchburg will pay their fair share of interest on debt through tuition. Branchburg’s high school students are an integral part of the Somerville District; we have a long-standing send-receive relationship. Branchburg pays tuition to Somerville Public Schools, which changes based on the number of students they send to the high school each year.

STRATEGIC FINANCIAL PLANNING

The Board of Education worked closely with district administrators and architects to thoroughly evaluate district needs to determine which projects qualify for state aid and enhance the student experience.

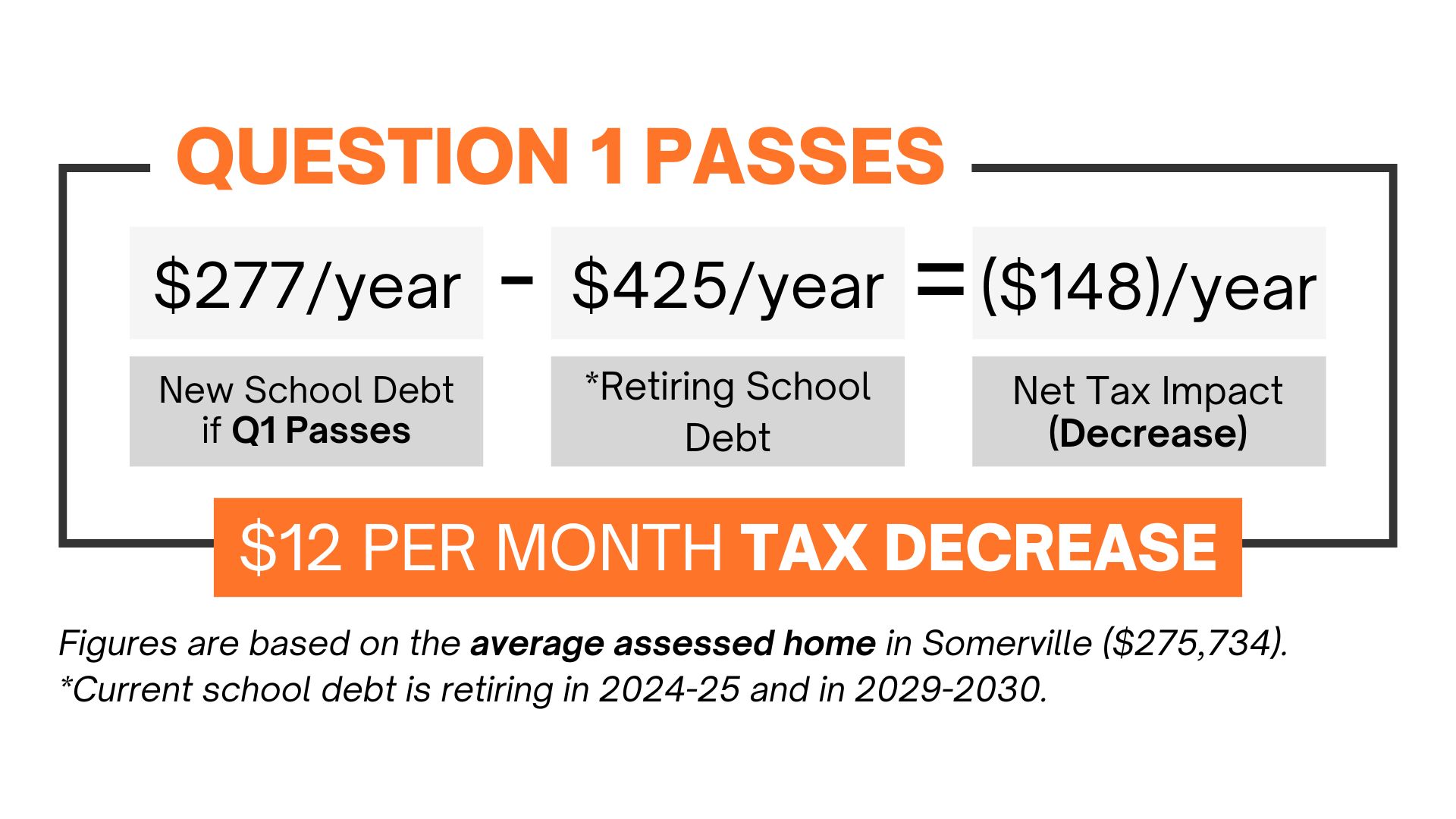

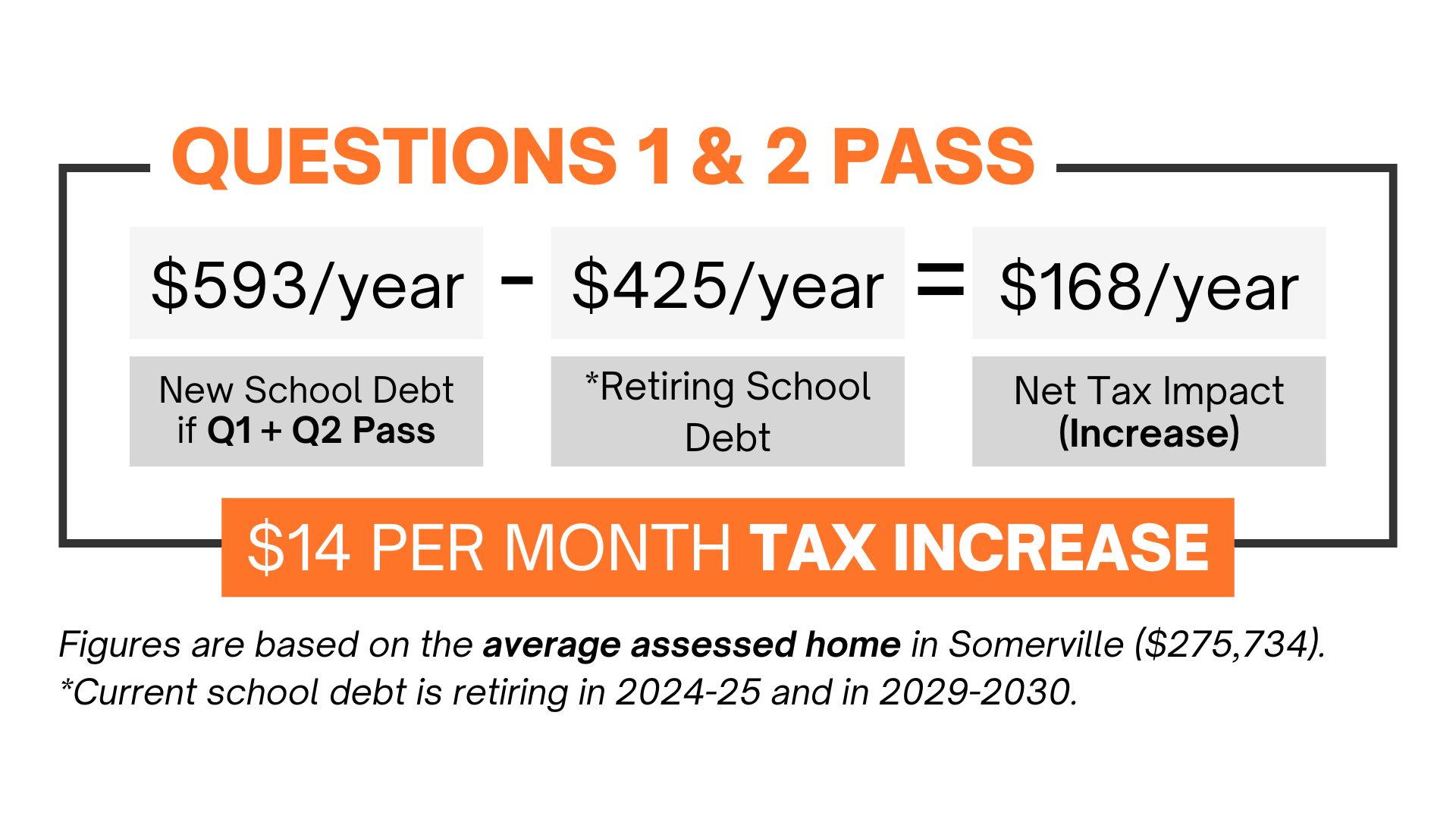

Through good financial planning, our community can decide whether to continue investing in the schools at a similar level to what was done in the past.

SIGNIFICANT STATE AID

Many projects are eligible for state aid when approved through a bond referendum. In Somerville’s case, Question 1 receives $7.2 million state aid to cover a portion of the $23.2 million in total costs and Question 2 receives $168,500 in state aid to cover a portion of the $20.8 million in total costs.

That’s money Somerville residents, as well as every other New Jersey residents already paid to the state through taxes. Only communities that approve a bond referendum have access to that specific type of state aid. We either receive those funds through bond borrowing through an approved referendum, or we lose access to it!

ASSESSED VALUE

Assessed value is used to calculate how much a person pays for taxes. In today's market, a home's assessed value is typically lower than the market value.